Broadcom's 10-for-1 Stock Split: A Boost for Investors

Broadcom, a leading semiconductor and infrastructure software solutions provider, has announced its own 10-for-1 stock split.

Following the footsteps of NVIDIA’s (NASDAQ:NVDA) recent 10-for-1 stock split, Broadcom (NASDAQ:AVGO), a leading semiconductor and infrastructure software solutions provider, has announced its own 10-for-1 stock split.

This exciting development has sent Broadcom’s stock soaring by 14% in premarket trading, highlighting the positive sentiment surrounding the company’s impressive performance and future prospects.

Stellar Q2 Performance

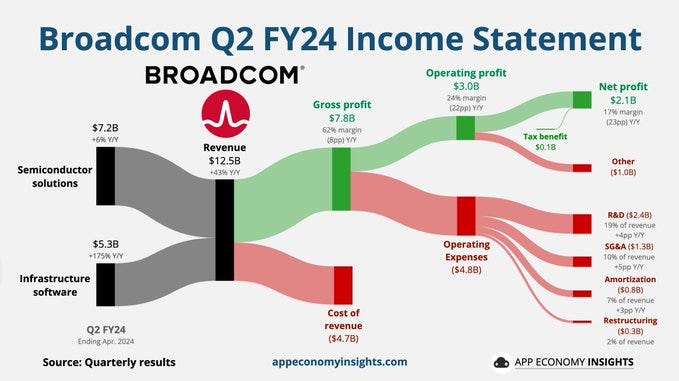

Broadcom's announcement coincides with the release of its second-quarter results, which have once again surpassed Wall Street expectations. This marks the ninth consecutive quarter that Broadcom has outperformed earnings forecasts.

The company reported a remarkable 43% year-over-year increase in sales, driven by significant growth in its AI segment. Broadcom's AI revenue skyrocketed by 280% over the prior year, reaching an impressive $3.1 billion.

Details of the Stock Split

The highly anticipated 10-for-1 forward stock split is set to make Broadcom’s shares more accessible and attractive to a broader range of investors, including retail investors and employees.

The record date for the split is July 11, with the stock expected to begin trading on a split-adjusted basis on July 15. Post-split, Broadcom’s share count will increase to approximately 4.92 billion.

Market Impact and Analyst Sentiment

The market reaction to Broadcom’s announcement has been overwhelmingly positive, with the stock experiencing a substantial premarket surge. This upbeat sentiment is echoed by top Wall Street analysts who are weighing in on the stock’s potential.

Broadcom's solid performance, particularly in the AI sector, underscores its growing importance in supplying AI chips to major tech companies, further solidifying its position in this lucrative market.

Broadcom's Growth Trajectory

Broadcom’s robust Q2 results are complemented by its successful acquisition of VMware in November 2023, which has significantly impacted its infrastructure software segment.

The company's revenue for the quarter came in at $12.5 billion, exceeding expectations by $480 million. Non-GAAP EPS was reported at $10.96, beating forecasts by $0.12.

For fiscal year 2024, Broadcom projects revenue of approximately $51 billion, slightly above the expected $50.3 billion, with an adjusted EBITDA margin of around 61%.

Conclusion

Broadcom’s 10-for-1 stock split is a strategic move aimed at making its shares more accessible, enhancing their appeal to a wider range of investors. Coupled with its stellar Q2 performance and bullish future guidance, Broadcom is poised to continue its upward trajectory.

Investors are excited about the company’s potential, particularly in the booming AI chip market, and the stock split serves as the perfect catalyst to drive further interest and investment in Broadcom.